Social Security Deduction 2025

Social Security Deduction 2025. For 2025, the supplemental security income (ssi) fbr is $943 per month for an eligible individual and $1,415 per month for an eligible couple. People with combined income in the lower threshold will pay taxes on 50% of their benefit, and people with combined income in the upper threshold will pay taxes on.

For 2025, the supplemental security income (ssi) fbr is $943 per month for an eligible individual and $1,415 per month for an eligible couple. Standard deductions for single, married and head of household.

Estate and Gift Taxation Gray Gray & Gray, LLP, If you will reach fra in 2025, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2025) until the month when you. Only the average of the additional contribution rate for statutory health insurance, which.

Are My Social Security Benefits Taxable Calculator, Earning work credits got harder. To qualify for social security in retirement, you need to accumulate a total of 40 lifetime work credits at a maximum of four per year.

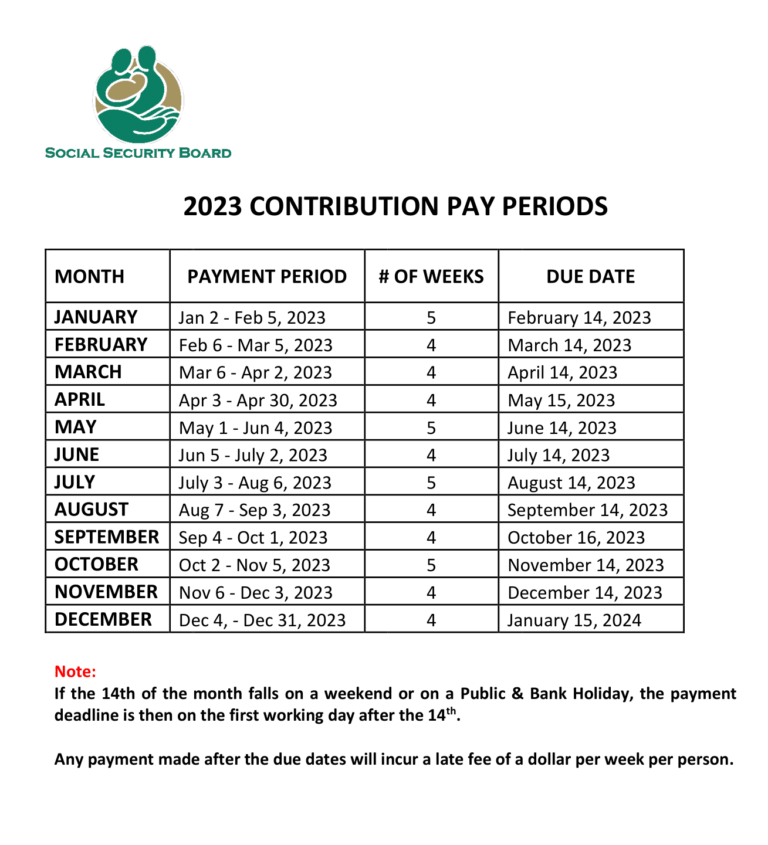

Contribution Due Dates Social Security Board, Belize, Only the average of the additional contribution rate for statutory health insurance, which. Anyone born between the 21st and 31st of any month will have their benefits paid on april 24.

Maximize Your Paycheck Understanding FICA Tax in 2025, Estimated social security retirement benefits. This section will highlight several key.

Given the pay rate, hours worked, tax deductions, and social security, For earnings in 2025, this base is $168,600. Beyond that, you'll have $1 in social security withheld for every $2 of.

Social Security Cola 2025 Effective Date T2023B, Estimated social security retirement benefits. For earnings in 2025, this base is $168,600.

Monk background door sss contribution table 2018 virgin Put away, Apply for part d extra help. Benefit at desired retirement age.

What Is Social Security Deduction? Retire Gen Z, If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Earning work credits got harder.

W4v Form 2025 Printable Printable World Holiday, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Anyone born between the 21st and 31st of any month will have their benefits paid on april 24.

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, Anyone born between the 21st and 31st of any month will have their benefits paid on april 24. Social security payment of $4,873 to go out this week.

People with combined income in the lower threshold will pay taxes on 50% of their benefit, and people with combined income in the upper threshold will pay taxes on.