High Deductible Health Plan Minimum Deductible 2025

High Deductible Health Plan Minimum Deductible 2025. Minimum deductible for an individual. For taxable years beginning in 2025, the term “high deductible health plan” means, for family coverage, a health plan that has an annual deductible that is not less than $5,550.

For taxable years beginning in 2025, the term “high deductible health plan” means, for family coverage, a health plan that has an annual deductible that is not less than $5,550.

Can I Deduct My Electric Vehicle In 2025 Calendar Liva Alethea, High deductible health plan (hdhp) faqs 2025 plan year for the state employee & retiree health plan The 2025 minimum deductible for individual coverage increases by $100 to $1,600.

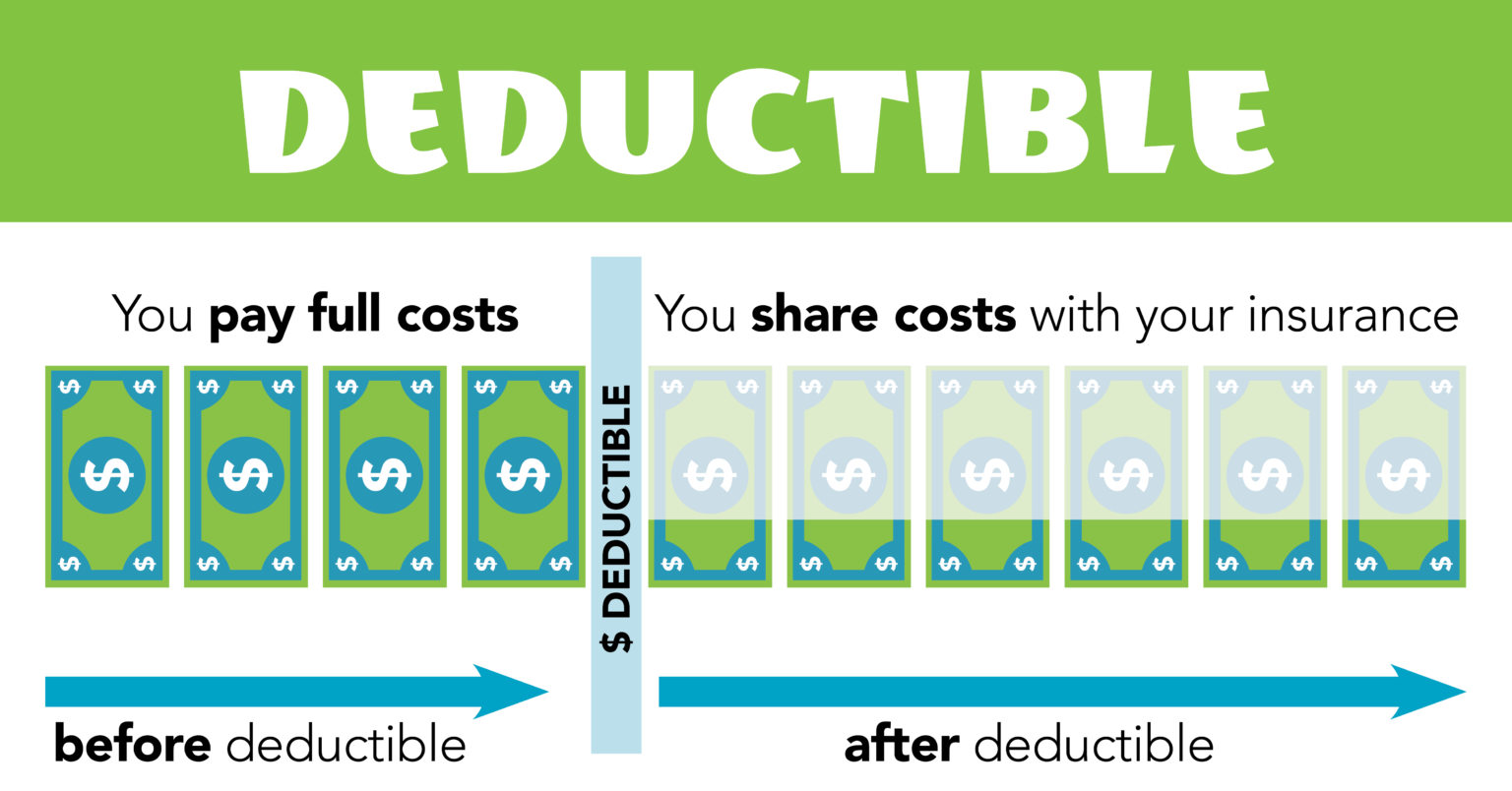

HighDeductible Health Plans Can Waive Deductible for Coronavirus, If you have an hdhp, your insurance will not kick in until you hit at least these minimums. New hsa/hdhp limits for 2025.

How to Explain HighDeductible Plans, If you have an hdhp, your insurance will not kick in until you hit at least these minimums. The 2025 minimum deductible for individual coverage increases by $100 to $1,600.

Explaining a High Deductible Health Plan [Infographic], Minimum deductible for an individual. High deductible health plan (hdhp) faqs 2025 plan year for the state employee & retiree health plan

![Explaining a High Deductible Health Plan [Infographic]](https://selecthealth.org/-/media/selecthealth/blogs/post/2019/12/understandinghdhp_blog_lg.ashx)

Expert tip Study your plan design, whether it comes from your employer, To qualify as an hdhp in 2025 , an individual plan must have a. The irs defines an hdhp as any plan with a deductible minimum of:

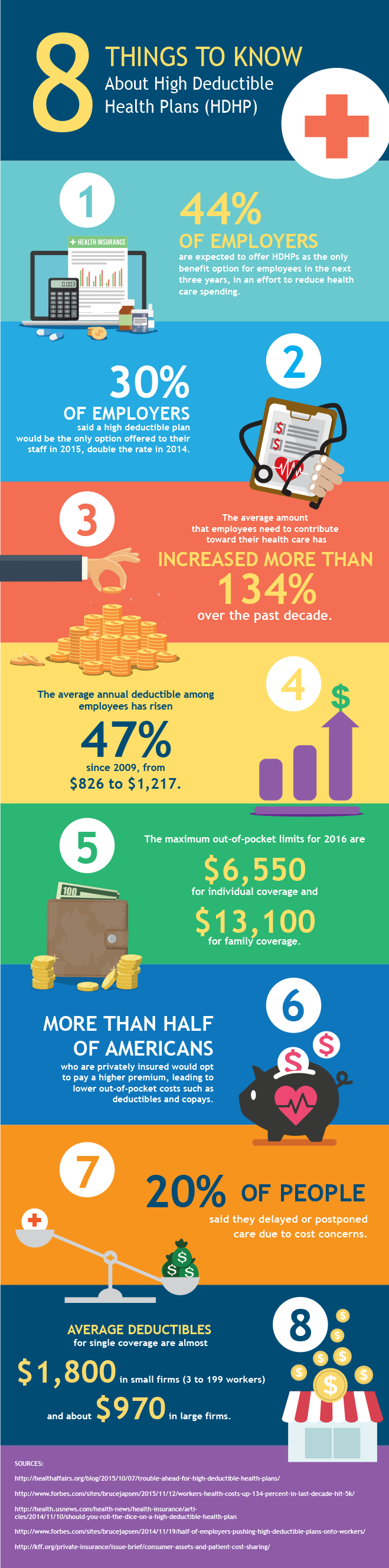

Ask the Benefits Expert High Deductible Health Plans Tandem HR, 2025 contributions and deductibles effective for 2025, the annual contribution. But when we look at deductibles in general, they've.

High deductible health plan (HDHP) pros and cons, The 2025 minimum deductible for family coverage increases by $200 to $3,200. High deductible health plan (hdhp) faqs 2025 plan year for the state employee & retiree health plan

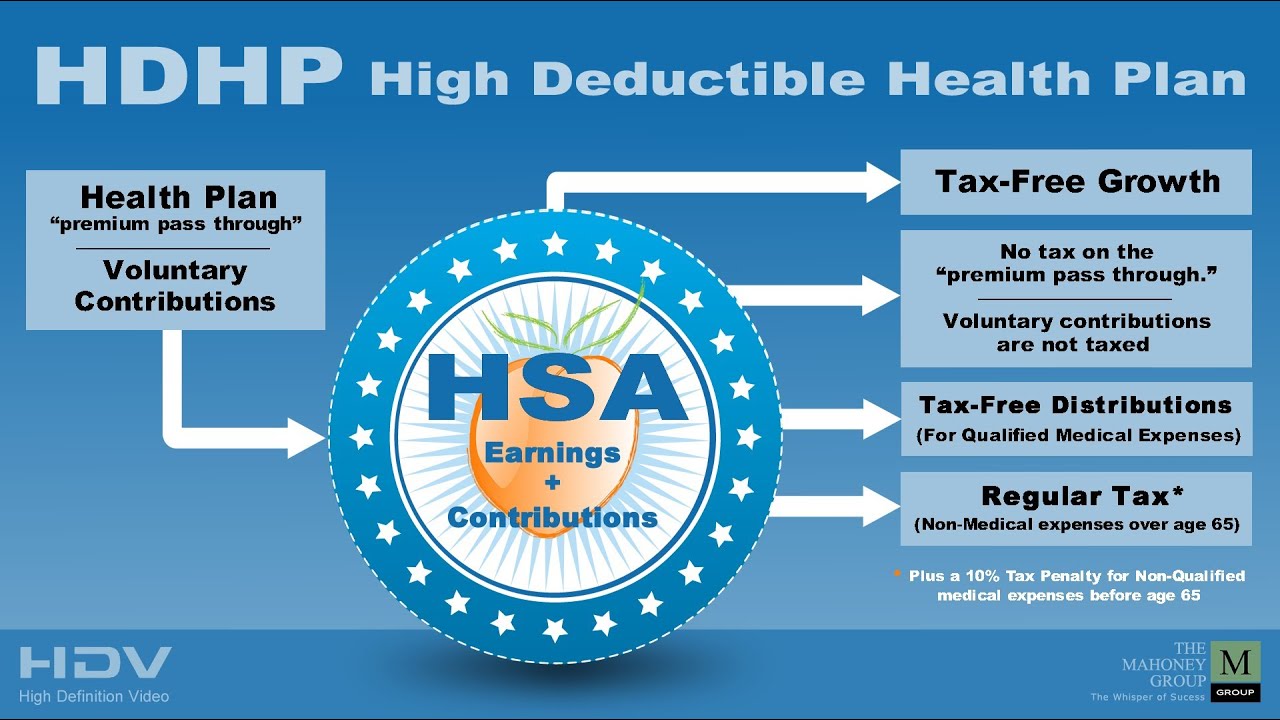

HDHP High Deductible Health Plan, YouTube, To qualify as an hdhp in 2025 , an individual plan must have a. 2025 contributions and deductibles effective for 2025, the annual contribution.

A look at highdeductible health plans Postal Times, Since then, the minimum hdhp deductible has increased by more than 50%, to $1,600 and $3,200, respectively, for 2025. For example, an hdhp with a july 1 plan year would not be subject to the 2025 $1,600/$3,200 minimum deductible amounts until the plan year of july 1, 2025, which.

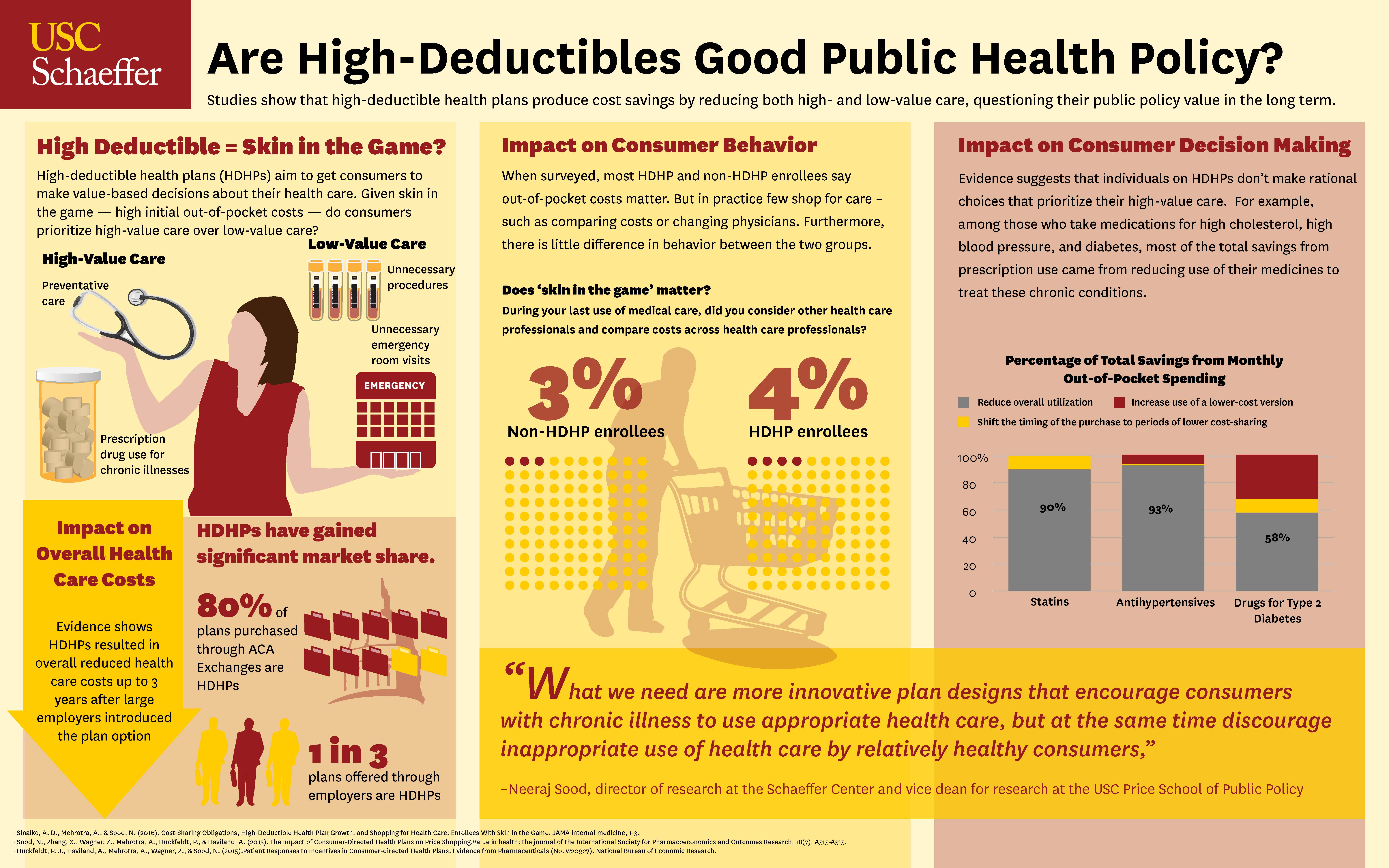

Are HighDeductible Plans a Healthy Option for Patients? USC Schaeffer, Consider 2025 hsa/hdhp and excepted benefits hra limits when finalizing 2025 plan designs. 2025 minimum hdhp annual deductible:

Since then, the minimum hdhp deductible has increased by more than 50%, to $1,600 and $3,200, respectively, for 2025.